Montgomery County Leadership: Blair Rush, Southeast Region President at C&N

Blair Rush, Southeast Region President at C&N, spoke with MONTCO Today about spending his entire life in Bucks County; his memories playing baseball and how the sport helped him become a leader; how being diagnosed with diabetes as a teenager changed his life; and beginning his banking career right out of high school and then working toward a college degree at night.

Rush also discussed how he took to banking so quickly; what priorities and opportunities the bank is focused on as pandemic restrictions ease; and the identity that C&N is creating for itself as it expands its footprint in the Delaware Valley.

Where were you born, Blair, and where did you grow up?

I was born a twin in Grandview Hospital in Sellersville. I’ve lived in Upper Bucks County in the Pennridge School District my entire life. I’ve never lived anywhere else! I grew up in Perkasie and bought a house in Sellersville, and I settled in Bedminster Township. So, I’ve been in Bucks County and the Delaware Valley for 59.5 years.

What did your parents do?

They were both working-class people, and neither of them had a college education. My dad was the head groundskeeper at Pennridge High School, and a Pennridge High School bus driver. My mom was a secretary in an elementary school.

They were both the oldest of nine children, so I have many relatives and cousins that lived in Upper Bucks County.

What memories stay with you?

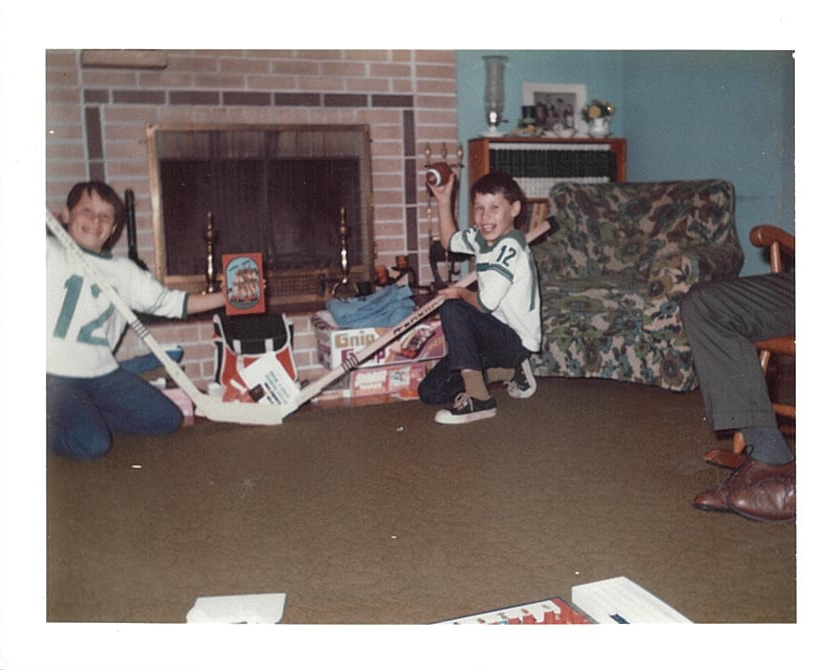

My twin brother and I got along very well and were very competitive. He’s still my best friend today and also lives in the Pennridge School District. Being a twin, I always had someone to play with. We also had a lot of cousins around to do things with as well.

What was the first job you ever had?

The first job I ever had was a paper route for the Philadelphia Bulletin with my brother. Right away, I learned that you can’t be late with the paper, and if someone wants the newspaper on their doorstep, you put it on their front doorstep. I didn’t like the paper to get wet.

After the paper route, I had a few odd jobs, but my first real hourly job was working for the bank after high school.

What kind of music were you listening to back then?

I was and still am a big Billy Joel fan. He’s always been my favorite.

What sports did you play?

We played everything, but I focused on baseball because of my height. I’m only 5’6″, so it’s a little easier to excel at baseball at that height. I was the second baseman, and my brother was the shortstop. Our senior year, we went to the state playoffs, so we were pretty good.

Do you have a game you remember the most?

Not necessarily a game, but my senior year we were 16-2 and Bux-Mont League co-champions with Upper Perk. We beat Upper Perk both times we played them during the season, so we always felt we were the true champion. Sometimes it is hard to forget the games we lose more than the games we won. The loss to Boyertown in the state playoffs was difficult to get over.

Who was your favorite baseball player of all time?

Mike Schmidt. I think he is one of the best third basemen of all time.

Did you play baseball in college?

No, I went right into banking from high school. I finished my education through Delaware Valley College, now Delaware Valley University in Doylestown in the continuing ed program. I was working during the day and going to college at night two nights a week.

After high school, I started with Bucks County Bank as a teller. Then when I was twenty-one, I was promoted to head teller before becoming the branch manager at twenty-three. My career in banking took off from there.

Were you a good student in high school?

I was more into sports and the student part wasn’t my number one priority. All that changed, however, on my sixteenth birthday when I was diagnosed with Type 1 diabetes.

That was 1977, so there was a lot we didn’t understand about diabetes. We’ve learned a lot about the disease since then. That was a dramatic experience.

I look back on how that diagnosis defined me. I became extremely organized, disciplined, and focused. I had to give myself an insulin shot every day and control my blood sugar. I had to eat at certain times. Today, I have an insulin pump and continuous glucose monitoring system so it does the work of controlling my blood sugar all on its own. Back then, however, I had to do it all myself.

What made you focus?

At that time, people with diabetes were only living until forty or fifty. Expectations were low. I wanted as normal a life as possible and did not want to be different. I needed to take good care of myself. I was disciplined about how and when I ate, when I took my insulin and made sure I exercised. If I didn’t make that commitment, I’m not sure I would still be here today.

How did that diagnosis impact your decision to not go to college?

I wasn’t ready to go away to college yet. I had an uncle who worked for Bucks County Bank who suggested that I might enjoy banking. He observed that I liked numbers and enjoyed dealing with people and thought a career in banking would be a good fit. I started as a teller at the Plumsteadville office of Bucks County Bank.

The bank took a risk on you. What did they see in you?

True. My first interview at Bucks County Bank, I didn’t get the job. I interviewed for a position at the Chalfont main office. The woman they hired instead of me only worked there six months and left. However, John Ulmer, the Plumsteadville Office Manager hired me. For years, I would remind the manager that didn’t hire me, George Taylor, that he did not hire me. We used to have fun with that. I was teller, head teller, assistant manager, and manager at several Bucks County Bank offices.

What made you take to banking so quickly?

I think I excelled because I like people, and I like helping people be successful. It’s a people oriented business. In my various positions at the bank, I learned so many different things and worked with many different people.

You became a leader during this period.

Many times, I’ve been told that I am a natural leader. My ability to lead goes back to baseball as well as my diabetes diagnosis. I needed to take so much care of myself to live normally, and that translated to me wanting to also help other people.

How long did it take you to get your degree?

I started my college education at Del Val a year after I went into banking. A friend of mine who grew up on the same street and worked at Bucks County Bank was going to Del Val for a business degree, so we would travel together for several years while we both went there. It took me ten years to get my degree while also getting married and raising a family.

I could work during the day and go to school at night. I was able to apply what I was learning at work to my classroom studies and vice versa.

Who were the people over your career who saw your potential and gave you a break?

I started at Bucks County Bank on the retail side and was also involved with small business lending. Bucks County Bank was part of a holding company called Independence Bancorp. In 1994, it was announced that CoreStates was buying Independence Bancorp. I had a position on the retail side, but it wasn’t for me.

A man by the name of John Spier, President of Bucks County Bank, said he was going to start a denovo bank. Another man, Pete Dominic, who was the Executive Vice President at Bucks County Bank, called me and said they had an opportunity for me. I was thirty-three at the time, with a six-year-old daughter and a one-and-a-half-year-old son, and they asked me to join them. I spoke with my wife about it, and I said I wanted to do it. Best business decision by far I ever made.

What did they see in you?

I worked directly with Pete. I think they saw a young man who interacted well with people, who had drive and motivation, wanted to be successful, wanted to take care of clients, and thought we would be successful as a team.

We started First Service Bank on July 13, 1995 and built the bank to $400 million in assets in seven-and-a-half years. We sold First Service Bank to National Penn Bank in February 2003. I was EVP, responsible for lending, retail and all bank operations when it was sold. John Spier was the CEO. The bank had a wealth group and an insurance group.

When National Penn bought us in 2003, I was given the opportunity to be President of First Service Bank, a division of National Penn Bank.

My responsibilities grew during my time with National Penn as National Penn grew from a $3 billion asset company to a $9.6 billion asset company before selling to BB&T. I was the Eastern Region President at National Penn at the time of the sale.

How did you do during the 2008 – 2009 crisis?

That was a very difficult time for banks. It tested client relationships as well. There were clients we couldn’t help as much as we wanted to during that period. It was challenging, but we are all better bankers because of it.

Is there anyone else looking back on your career that opened doors for you?

At National Penn, Glenn Moyer, Scott Fainor and Dave Kennedy were part of my career growth as well. When National Penn sold to BB&T in 2016, I was able to opt-out of my contract. That’s when John Spier entered my business career again. He was involved with a bank called Milestone, which had some challenges. John became CEO in late 2014, and he had brought in a new management and lending team.

When National Penn sold, John Spier reached out to me and asked me to join the continued rehab of Milestone, which later rebranded in 2015 as Covenant Bank. I had opportunities with several banks, and I thought I could either make the safe decision or take a challenge with more risk but a new experience. I knew John, and who he was surrounding himself with, so I went with him when he offered me the position of President and COO of Covenant Bank.

At that time, it was a $260 million asset-based bank, and we grew it to over $500 million. It was a turnaround bank, and we had multiple interested buyers when we decided to sell in December 2019. We merged with C&N in July 2020. I serve as Southeast Region President at C&N.

I look at my banking career, starting with Bucks County Bank to now. I worked in a quality community bank, started a bank, grew with a bank, worked in a turnaround bank, and am now with another great company. I look at C&N’s values, and they align with mine.

Looking forward, what are the priorities and opportunities you are focused on?

Our focus is growing C&N’s brand in southeast Pennsylvania. C&N’s headquarters are in Wellsboro which is three-and-a-half hours away from our office in Doylestown. Some people are not familiar with who C&N is. We want to focus on taking care of our clients, as well as organically growing.

What do you want C&N to be known for?

C&N is a relationship-oriented financial institution. We want to develop long-lasting relationships with clients, with trust and an understanding that we are a resource for their financial needs. We can be a partner with them to help them be successful in whatever goals they have – banking, wealth management, and insurance. We want our customers to say, C&N is the only bank they need.

We have a strong business perspective here, and I’d like to grow the consumer perspective more.

We only have four branches in the market, which is comprised of Bucks, Montgomery, Chester, Delaware, and Philadelphia. I’d like to grow across the river into New Jersey, up to the Lehigh Valley, and out to Lancaster.

Will you grow your branch footprint?

We are always considering opportunities and locations to grow the branch footprint.

We are still dealing with the COVID-19 situation. There is light at the end of the tunnel, and I think there is a lot of opportunity for economic growth in the region. There will be many opportunities for banks, and we will certainly look to grow our customer base.

The major emphasis of my role is to make sure we are all working together as one team and taking care of our client needs. At the end of the day, C&N is probably not finished buying banks either.

What do you do in your spare time?

I’m a big sports fan. My wife and children love sports too. I have Eagles and Sixers season tickets, so we get to a good amount of games. My adult children live and work in Philadelphia, and going to and watching games together is a great family activity. My brother lives and works in Upper Bucks County, so our families have a lot of opportunities to get together.

I have a place at Lake Wallenpaupackso we can get away and go boating, participate in water sports and enjoy other fun outdoor activities.

Finally, Blair, what is the best piece of advice you ever received?

My dad always said, “if you say you’re going to do it, Blair, make sure you do it.” I think that’s a great piece of advice and so simple. He also told me to respect everyone and to listen with an open mind.

Another piece of advice would be from my colleague John Spier, who once told me, “there’s a lot of value in being smart but to be successful in business, make sure you are making wise decisions.” I agree with that and appreciate it. I strive to make sure that I am not only making smart decisions, but more importantly making wise decisions. There is a difference.

Stay Connected, Stay Informed

Subscribe for great stories in your community!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://montco.today/wp-content/uploads/sites/2/2023/03/95000-1023_ACJ_BannerAd1.jpg)

![ForAll_Digital-Ad_Dan_1940x300[59]](https://montco.today/wp-content/uploads/sites/2/2022/06/ForAll_Digital-Ad_Dan_1940x30059.jpg)