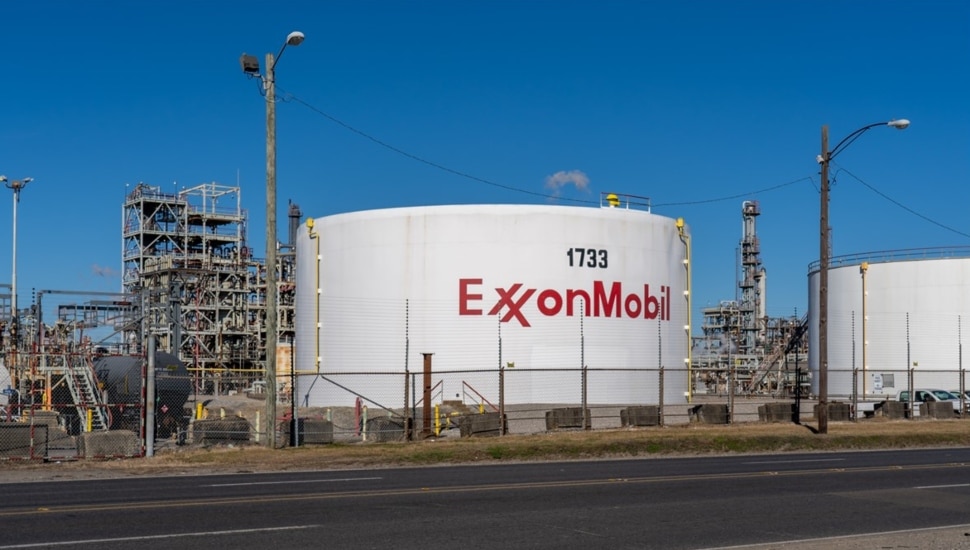

‘A Major Narrative Change’: Exxon’s Surge Points to Market Shift Not to Be Ignored by Investors

Exxon Mobil’s surge throughout the year put the oil company on par with the leading tech stocks, pointing to an important shift in the market that should not be ignored by investors, in case the narrative changes again, writes James Mackintosh for The Wall Street Journal.

When compared to the four top tech stocks, Exxon would be in fourth place this year with a growth of 21 percent, behind Nvidia and Meta and close to Amazon.

Do you trust the markets to take care of your future? In today’s economic environment, having options besides public stock, bonds, and mutual funds may reduce the risk in most portfolios.

Learn more about accredited investing and alternative assets.

Exxon is currently at the center of two main stories: the strong demand for oil due to a stronger-than-expected economy, and supply problems caused by wars in Ukraine and the Middle East. Both issues were on show last week, as oil increased on Friday due to strong jobs figures a day after rising from concerns about Israel–Iran escalation on Thursday. In both of these cases, oil stocks are winners, while the rest of the market prefers one or the other.

Until recently, the focus among investors has been primarily on the falling inflation bringing down bond yields. While markets are still considering inflation, the main focus has shifted to the stronger-than-expected economy, which increases demand for oil. This has put the S&P 500 energy sector, and its biggest member, Exxon, ahead of the tech sector for the year. On Friday, the energy sector also surpassed communication services — Meta and Alphabet included — when dividends are considered.

But the problem with growth is that it is not infinite and depends on the price of oil. When demand rises, so does the oil price. But too much demand and continuously rising prices result in a loss for the rest of the economy.

This can lead to another change in narrative, as investors will go back to worrying about rising prices once again.

According to Shamik Dhar, chief economist of BNY Mellon Investment Management, the big change in narrative will most likely occur if markets go from pricing fewer rate cuts by the Fed to once again preparing for actual rate rises.

“Then you get a major narrative change,” he said. “Markets like relatively simple stories to hang their hat on.”

Fred Hubler, the CEO and Chief Wealth Strategist for Creative Capital Wealth Management Group in Chester Springs, has been bullish on energy for the last three years.

“Our clients have been served very well investing in oil/gas programs,” he said. “Some of these programs provide a beneficial reduction of taxable income, and who doesn’t want to pay less in taxes?”

Hubler, who penned an article for Forbes.com on the topic, has different ways for his clients to participate in the oil/gas sector.

“Our clients can gain exposure with oil and gas several different ways,” he said. “There are programs that reduce taxes, as well as growth programs that aggregate smaller plots and sell them to a larger firm once the small plots amount to approximately 6,000 barrels of production. Either way, oil is not going anywhere any time soon.”

Read more about the market shift in The Wall Street Journal.

Want to know if you’re on the right path financially? Creative Capital Wealth Management Group’s Second Opinion Service (SOS) is a no-obligation review with one of CCWMG’s Wealth Strategists.

Schedule an SOS Meeting with Fred Hubler and his team.

Stay Connected, Stay Informed

Subscribe for great stories in your community!

"*" indicates required fields

![ForAll_Digital-Ad_Dan_1940x300[59]](https://montco.today/wp-content/uploads/sites/2/2022/06/ForAll_Digital-Ad_Dan_1940x30059.jpg)

![95000-1023_ACJ_BannerAd[1]](https://montco.today/wp-content/uploads/sites/2/2023/03/95000-1023_ACJ_BannerAd1.jpg)